Table Of Content

But the labor market has outperformed expectations in 2023, kicking off the year with a blockbuster half million jobs added and long-term low unemployment rate in January. The jobs market has continued to exceed expectations with both payroll and household surveys surprising in April. May data was more mixed, with an unexpectedly large number of jobs added according to the payroll survey despite an uptick in unemployment in the household survey. Even after the uptick, the unemployment rate remained at just 3.7%, better than anticipated in our original outlook. While wage growth continues to exceed pre-pandemic pace, paychecks are still not keeping up with inflation meaning that despite rising incomes, households continue to lose income-based purchasing power. Ongoing spending is supported by dipping into the still-large stockpile of savings accumulated during the pandemic, which is expected to last through 2023.

Is it smart to buy real estate before a recession?

While many homeowners are excited to sell their homes at today’s levels, doing so would mean entering the market themselves. Buyers, on the other hand, have been forced to endure steep price increases due to the amount of competition in the Los Angeles County housing market. Not only have expensive homes priced buyers out of the market, but many people simply couldn’t find a home in the first place. Finally, if we look at the year-over-year distribution of metro-level data by region, we can see that Western urban areas were hit particularly hard but are now making a comeback. Exhibit 4 shows that the distribution of Western metro annual house price growth centered below 0% for the first six months of 2023, but has quickly shifted to above 0% in recent months.

More From the Los Angeles Times

Rental building activity is likely to fall slightly in 2023, but not as much as construction of single-family homes. Some construction spending will shift to remodels, as many Americans who were hoping to move will instead opt to renovate in the face of high mortgage rates. The California real estate market is one of the most expensive in the U.S. that’s adjusting to higher mortgage rates and rising inflation. However, the Golden State housing market remains healthy in its various regions, including the tech-savvy Bay Area and multi-faceted Southern California.

Los Angeles Real Estate Market 2022 Overview

But the pause button was released fairly quickly and low-interest rates meant to encourage ongoing pandemic activity had the L.A. The Los Angeles real estate market has captured the attention of investors around the globe. Thanks, in large part, to a thriving economy deeply rooted in the entertainment industry, LA is not only the beneficiary of strong fundamentals but also constant demand. At the very least, the city’s most desirable features will continue to attract people from around the world.

The overarching trends that drove the national forecast, are visible in these top markets. Then the party ended with a thud last spring when mortgage rates doubled in a matter of months. Buyers evaporated from the market, unable to pay the staggering cost of buying a home in this new reality.

That’s down sharply from its forecast in March, when it predicted home prices would rise 2.5% in 2024 and 2.1% 2025. The view for 2024 has suffered especially compared to the start of the year, when prices were seen rising 2.8%. In Los Angeles, the availability of low-interest rates will be a contributing factor to home sales, particularly current homeowners looking to move into larger houses—although some of those home expansions may take them further afield. For context, home values have been increasing for the better part of a decade.

Housing Market Predictions 2023: A Post-Pandemic Sales Slump Will Push Home Prices Down For the First Time in a Decade

Higher costs have pushed households to be creative when navigating the housing market. At the same time, a smaller number of buyers has somewhat lessened competitiveness in many markets. As a result, down payments have declined, creating an opening for buyers with more limited funds, such as first time buyers, who were most challenged by the hunger-games-like conditions of the past few years. Our cross-market demand report shows that the share of home shoppers looking for homes somewhere other than their current market continues to grow, especially in the Northeast and out of market shopping remains high in the pricey West. We expect mortgage delinquencies to rise as disposable income levels and consumer savings diminish. However, given the default management toolkit and large amounts of home equity, we are unlikely to see a material increase in foreclosure activity that leads to distressed property sales.

California Housing Market Trends

As fewer households make the jump to homeownership, increased rental demand could help keep rents moving higher. Nationwide, the median rental is projected to increase 6.3% in price, even as an influx of new multifamily housing helps to better meet rental demand. Renters looking to save in the year ahead may consider moving further out to the suburbs. Even as sales fell, luxury house prices continued to grow this year, topping $1.15 million in September, a new record and higher than any point in 2022.

Texas Housing Market 2024: Trends and Forecast - Norada Real Estate Investments

Texas Housing Market 2024: Trends and Forecast.

Posted: Wed, 03 Apr 2024 07:00:00 GMT [source]

Cincinnati (-41.9%), Newark (-24.3%), and New Brunswick (-21.9%) saw the biggest inventory declines, with Chicago coming in fourth.

This is a noticeable increase from the less than 50% who searched across geographies pre-pandemic. More U.S. cities will look to Minneapolis, which in 2019 became the first major city to eliminate single-family-only zoning, for inspiration in keeping rental and home prices under control. Earlier this year, Minneapolis became the first metro area to see rents decline. Some Americans will be priced out of climate-risky areas like beachfront Florida and the hills of California because of ballooning insurance costs.

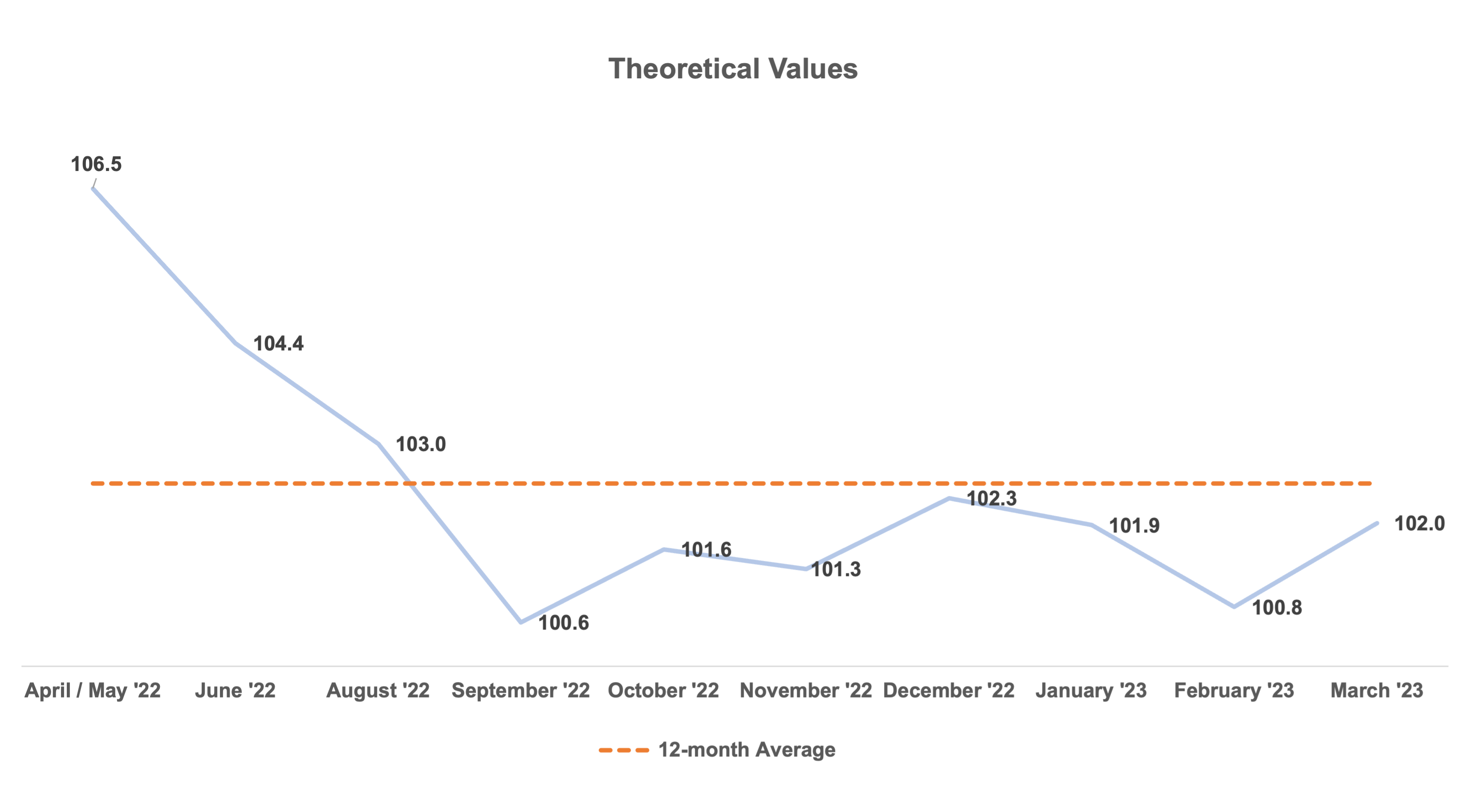

The gross domestic product will grow by 1.3%, roughly half the typical historical pace of 2.5%. After eclipsing 7% in late 2022, the 30-year fixed mortgage rate will settle at 5.7% as the Fed slows the pace of rate hikes to control inflation. After spiking tremendously from the pandemic, housing prices have slowed their stratospheric growth over the past few years. This is particularly true in a state like California, which typically has some of America’s most expensive real estate. But even with California’s elevated standards, certain markets are still extremely overpriced, according to data from Zillow and other providers analyzed by Florida Atlantic University’s College of Business. Researchers there created a proprietary methodology to see how much of a premium or discount home buyers were getting in each of the top 100 housing markets in the United States at current levels.

No comments:

Post a Comment